Cash Over Valuation (COV) for Resale HDB Flats: Fully Explained

What is Cash Over Valuation (COV)?

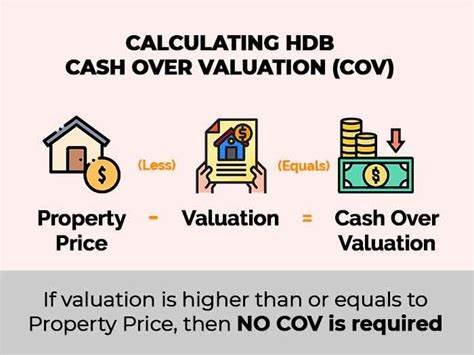

Cash Over Valuation (COV) refers to the difference between the resale price of an HDB flat and its official valuation as determined by HDB. This amount must be paid in cash by the buyer, as it cannot be covered by an HDB loan or CPF savings.

For example, if a resale HDB flat is sold for $550,000, but HDB’s official valuation is $520,000, the COV is $30,000. The buyer must pay this additional amount in cash, which can significantly impact affordability.

How is HDB Valuation Determined?

HDB assesses the market value of resale flats based on various factors, such as:

Recent transaction prices of similar flats in the same area

Location and surrounding amenities

Floor level and unit condition

Remaining lease duration

Sellers and buyers can request a valuation report from HDB only after a buyer has submitted an Option to Purchase (OTP). This prevents sellers from inflating prices based on valuation expectations. To get a better idea of the X-Value of your house, you can consult a realtor like myself.

The Role of COV in HDB Resale Transactions

COV plays a critical role in negotiations between buyers and sellers. Since it is an additional out-of-pocket expense that must be paid using only cash, buyers must assess their financial capacity before committing to an offer. In hot property markets, COV tends to rise due to high demand, whereas during slow markets, it may be minimal or even non-existent.

How to Calculate and Pay COV

Seller and Buyer Agree on a Price – The seller lists the HDB flat at a desired price, and the buyer negotiates an offer.

Buyer Applies for Valuation Report – After the OTP is granted, the buyer requests HDB’s official valuation.

HDB Issues the Valuation Report – This typically takes about 10 working days.

Determine the COV – If the agreed price is higher than the valuation, the buyer must pay the difference in cash. In some cases, a buyer and seller may re-negotiate on the selling price of the house but the OTP has to lapse and be re-issued.

Complete the Purchase – Once the valuation is finalized, the buyer proceeds with loan approval and completes the transaction.

Why COV Matters

Impacts Housing Affordability

High COV increases the upfront cash requirement, making flats less affordable for some buyers.

Market Sentiment Indicator

When COV is high, it signals strong demand for resale flats.

When COV is low or absent, it may indicate a buyer’s market.

Loan & CPF Limitations

Since COV must be paid in cash, buyers cannot use their CPF savings or housing loans to finance this amount.

How to Minimize COV

Conduct Market Research – Check recent transaction prices in the same area to gauge a reasonable offer.

Consult a Property Consultant - Realtors like me are familiar with transactional prices in specific areas hence we are better equipped to advice buyers and/or sellers of the housing valuation.

Negotiate Wisely – If a seller’s asking price is too high above valuation estimates, negotiate for a fairer deal.

Be Financially Prepared – Set aside cash savings to cover potential COV.

Consider Alternative Locations – Flats in less competitive areas may have little to no COV.

Trends in COV Prices

Historically, COV amounts fluctuate based on market conditions:

In 2013, COVs reached over $50,000 in some areas.

In 2014, HDB changed policies to prevent sellers from setting prices before valuation, reducing excessive COVs.

In 2022, a Straits Times article indicated that 1 out of 4 or 25% of homebuyers resale HDB flat buyers paid COV; an improvement from 33% in 2021.

Currently, COV levels vary based on demand, supply, and government housing policies.

Conclusion

COV is an essential factor in HDB resale transactions. Understanding how it works, its financial implications, and how to navigate COV negotiations can help buyers and sellers make informed decisions. Whether you are a buyer preparing cash reserves or a seller setting realistic expectations, staying updated on COV trends and HDB valuation policies is key to a smooth property transaction.

If you have further questions, feel free to clarify with me, happy to assist :)